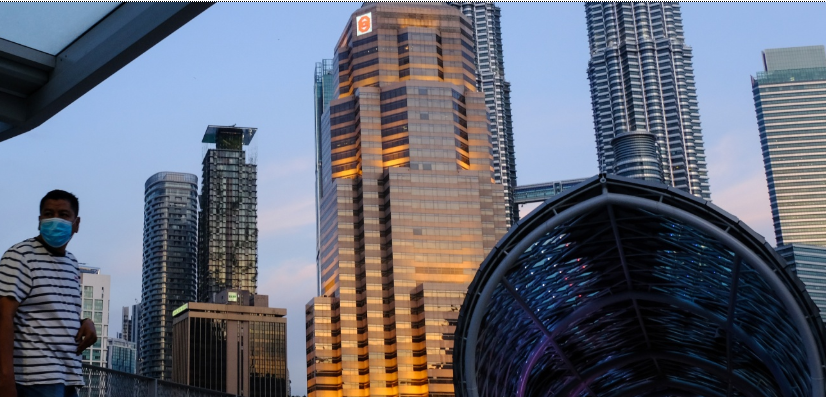

Malaysia’s technology cluster in Penang is helping drive an economic recovery that could see the country bounce back faster than any of its peers in Southeast Asia.

The northern state drew 6.8 billion ringgit ($1.6 billion) of foreign direct investment in the first quarter — almost two-thirds of the country’s total — attracting new projects even as the pandemic disrupted global supply chains and dampened demand worldwide. Approved investments in Penang nearly doubled from the previous three months, according to the InvestPenang investment promotion agency.

“Malaysia plays a key role in the global semiconductor supply chain, and has benefited from the tentative recovery in the electronics cycle,” said Wellian Wiranto, an economist at Oversea-Chinese Banking Corp. in Singapore. “That should put it in good stead for any global recovery next year.”

Gross domestic product data due next week is expected to show a contraction after the economy grew just 0.7% in the first quarter, its worst showing since 2009. The government has announced nearly $70 billion in stimulus — equal to about 20% of GDP — to cushion the effects of the pandemic, but unemployment has surged to 5.3%, the highest since at least 1990.

Analysts expect Malaysia to ride out the pandemic better than most peers. The World Bank sees Malaysia’s economy contracting 3.1% this year before rebounding 6.9% in 2021, besting neighbors like Vietnam and the Philippines next year. Fitch Ratings expects the country’s middle class, which includes 77% of households, to buffer the slump in external demand, while CGS-CIMB points to aggressive fiscal and monetary stimulus as reasons Malaysia should outperform others in Southeast Asia.

Record Surplus

Early signs of a rebound are evident in Malaysia’s exports: The trade surplus rose to a record in June as shipments climbed 8.8% from a year ago, driven by a 20-month high in electronics sales.

Penang already is reaping gains from the recovery. Medical device company DexCom Inc. will start building its first facility outside the U.S. on a 28-acre site in the second half of the year, while LEM Holding SA, which makes electrical components, has selected a site for a production facility. LEM is set to invest as much as 10 million Swiss francs ($11 million) in the project, making Switzerland the top foreign source of investment in Malaysia in the first quarter.

The government has been actively courting such investment: Malaysia’s stimulus package includes a 15-year tax exemption for manufacturers who invest more than 500 million ringgit, an investment tax allowance for companies relocating operations to the country and expedited approval process for manufacturing licenses.

The government has been effective in containing the spread of coronavirus, with a relatively low case count and mortality rate, said Jochen Schmittmann, head of the International Monetary Fund’s representative office in Singapore. The IMF projects Malaysia’s economy will shrink 3.8% this year before growing 6.3% in 2021

Political Instability

Risks, of course, remain. Malaysia remains wary of a resurgence of Covid-19, as new infections hit their highest level in a week on Wednesday. The country eased lockdown measures for most economic activities in May, after two months of closings that battered businesses.

Another key risk is the government’s tenuous grip on power. Prime Minister Muhyiddin Yassin’s razor-thin parliamentary majority elevates perceptions of political instability, potentially sidelining investment.

“The elephant in the room is domestic politics,” analysts at Malayan Banking Bhd. wrote in a research note.

For now, the opposition-held state government hopes Penang’s tech sector can help make the best out of the pandemic.

“There are still opportunities for Penang, particularly arising from global supply-chain reconfiguration and the emerging industries that will continue to play important roles in the post COVID-19 era,” Chief Minister Chow Kon Yeow said last month.

Source: Bloomberg