Penang, the Silicon Valley of the East, and Thailand – The Future of the Semiconductor Industry in Southeast Asia

In the first and second parts of this series, we introduced a coverage of the annual event in Southeast Asia by Semiconductor Equipment and Materials International (SEMI), which was held in Kuala Lumpur, Malaysia at the end of May. In fact, this “SEMICON Southeast Asia” was held in Singapore from 1994 to 2013, in Penang, Malaysia from 2014 to 2016, in Kuala Lumpur from 2017 to 2019, online in 2020 and 2021 during the COVID-19 pandemic, and in Penang again in 2022 and 2023. By looking at the changes in venue, we can see the history of development of the semiconductor industry in Southeast Asia, and the importance of Penang in particular. Furthermore, the number of visitors to SEMICON Southeast Asia this year seems to have been the same as last year, at over 18,000 people, but the number of exhibitors was 525 companies (from 20 countries and regions), a significant increase from 295 companies (17 countries and regions) in 2023.

High-end products remain in Penang

“Our semiconductor industry began 52 years ago and has a long history. Semiconductor companies such as Intel has been based here, as well as Japanese companies such as Hitachi’s semiconductor division (now Renesas Electronics). These companies realised that Penang was a very profitable place, so they developed human resources and built supply chains that included local companies. The semiconductor industry has seen many ups and downs, and in the early 2000s, China and Vietnam rose to prominence with some Penang companies relocating their cheap, low-end operations to these countries. However, they have maintained their high-value-added, high-end operations in Penang.”

InvestPenang CEO, Dato Loo Lee Lian

In an interview at the end of May, Dato’ Loo Lee Lian, CEO of InvestPenang, the investment promotion agency for Penang, gave this overview of the history of Penang’s semiconductor industry. She mentioned, “The people of Penang are hardworking and diligent, which has led to advances in technology and development of companies.” She then proudly stated, “Intel, the first US company to enter Penang, is leaving its design and high-end products in Penang, while also investing in cutting-edge packaging. We are proud of that.” In December 2021, Intel, a major US semiconductor company, announced plans to invest RM30 billion in Malaysia’s semiconductor production sector over 10 years, including building a new cutting-edge semiconductor manufacturing factory in Penang. During this interview in Penang, we were able to see the new factory under construction.

Intel’s new factory under construction in Penang

According to InvestPenang, there are currently over 350 multinational companies (MNC) and over 4,000 small and medium-sized enterprises (SME) in Penang. CEO Dato’ Loo also emphasised, “Of the world’s top 10 semiconductor companies, three American companies – Intel, Broadcom, and Micron – are based in Penang. In addition, six of the world’s top 30 medical device companies – Abbott from the US, B Braun from Germany, Boston Scientific from the US, Smith & Nephew from the UK, and Canon and Hoya from Japan – have bases here.”

![]()

![]()

“Map of Peninsular Malaysia and Features of Penang” Source: InvestPenang

Penang’s Importance in Malaysia’s Semiconductor Industry

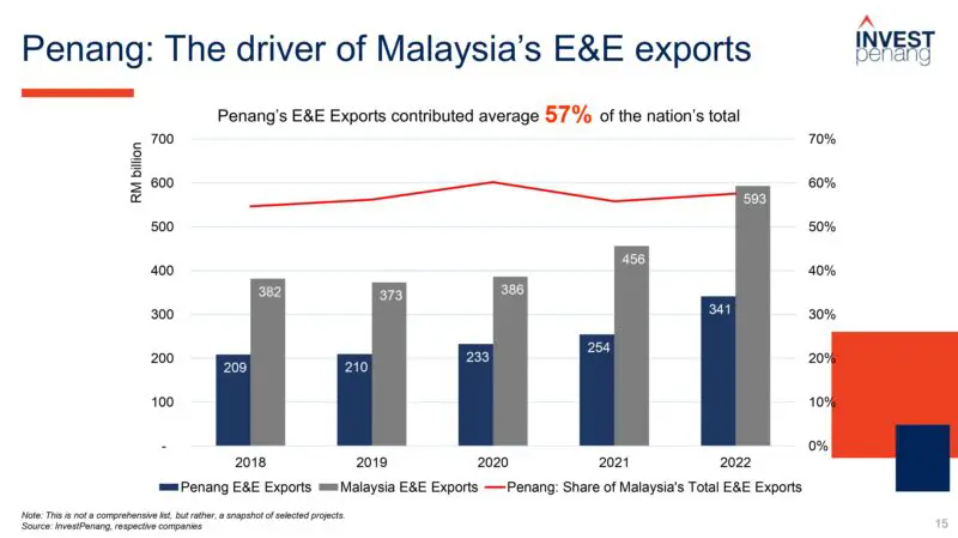

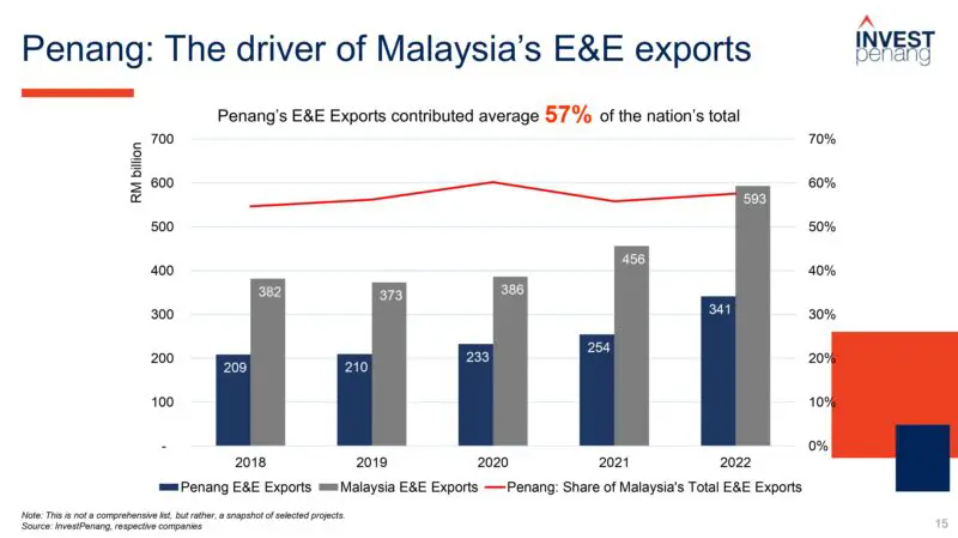

Penang’s GDP was RM112 billion in 2022, accounting for 7% of Malaysia’s total, and its GDP per capita was RM69,684, exceeding the Malaysian average of RM54,000. In addition, Penang’s manufacturing investment in 2023 was RM63.4 billion, 42% of Malaysia’s total, and foreign direct investment (FDI) in Penang was RM60.1 billion, accounting for 47% of the total. Penang’s exports were totalled to be RM435 billion, 31% of Malaysia’s total, of which electrical and electronics (E&E) exports accounted 57% of the total. The population of Penang is about 1.88 million, which is only about 5% of Malaysia’s total population (34 million), and it is rare for a state to have such economic power. This shows how high the added value from the semiconductor industry is. Additionally, in 2019, Penang was said to account for 5% of the world’s semiconductor exports.

“Trends in E&E exports in Penang and Malaysia” Source: InvestPenang

However, Penang also faces some challenges. It does not yet have a wafer fab, which is a core business in the semiconductor industry. When asked if there are plans to attract a wafer fab, InvestPenang CEO Dato Loo replied, “No, not at this time.” She explained that the reason is that wafer fabs use large amounts of resources such as water and electricity, but Penang Island has limited resources, making it unrealistic. However, the State of Penang includes not only Penang Island (about 300 square meters), which is also famous as a tourist destination, but also part of the northwestern part of the Malaysian Peninsula on the opposite shore, and the total area of the State of Penang is about 1,050 square kilometres. CEO Dato Loo emphasised, “Penang Island is already full and there is no land for a wafer fab, but we can prepare it on the Malaysian Peninsula. The two areas can be travelled between in about 30 minutes by car.” As of now, there are currently about 70 Japanese companies in Penang, and she explained, “Many Japanese companies used to come here, but since then, more companies have been expanding into Vietnam, and the number of Japanese companies in Penang has decreased.”

A sense of balance in maintaining neutrality in the US-China trade dispute

The friction between the US and China is particularly evident in the semiconductor sector. Regarding this, CEO Dato’ Loo said, “The US is trying to build its own supply chain and China is being forced to build its own supply chain, resulting in the creation of two supply chains in the world. I think now is a good opportunity for Malaysia to maintain its neutrality and participate in both supply chains. We also need a strategy to determine which sectors we will participate in. In order to protect resources and the interests of our people, and to secure jobs and income, we need to develop a strategy to determine the next era of industrialisation.”

In Thailand, the battle is now on between Japanese manufacturers, who have built a stronghold in the automotive sector for many years, maintaining a 90% market share, and Chinese manufacturers, who have been aggressively entering the market over the past two years with electric vehicles (EVs), taking over the market share. While the Thai government has made it clear that it supports EVs and Chinese EV manufacturers, it also keeps an eye on maintaining the Japanese internal combustion engine (ICE) vehicle industry, showing that the sense of balance that has allowed it to maintain its independence by skilfully navigating between major powers for many years with this practice still in place. I feel that Malaysia has the same shrewdness.

The Silicon Valley and Detroit of the East

“We are now focusing on other segments of the value chain. For example, an electric vehicle (EV) contains 3,000 chips (semiconductors), which is two to five times that of an internal combustion engine (ICE) vehicle. With the growth of the global EV market, Malaysia has the potential to become a supply hub for power semiconductors for EVs. These power semiconductors are also key technologies for energy transition and decarbonisation.”

The Prime Minister of Malaysia, Datuk Seri Anwar Ibrahim, also expressed strong enthusiasm for the supply of semiconductors for EVs in a special speech at SEMICON Southeast Asia 2024 held in Kuala Lumpur on May 28th. The Prime Minister emphasised that Malaysia has also introduced appropriate policies such as the New Industrial Master Plan 2030 (NIMP2030) and the National Energy Transition Roadmap (NETR) as incentives for companies wanting to produce power semiconductors.

Penang, Malaysia, has become the “Silicon Valley of the East,” and Thailand is known as the “Detroit of Asia.” It takes less than two hours by plane between the two cities. I wondered if there was any collaboration between the two countries to supply semiconductors manufactured in Penang to automobile factories in Thailand, so I asked semiconductor industry executives in Malaysia and other countries about this during my interviews. They all stressed the importance of regional cooperation, mentioning that, “It’s also possible to collaborate on ecosystems within the region.”

However, due to the unique nature of semiconductor chips, which are tiny products and related products that travel all over the world through complex and diverse manufacturing processes, it was pointed out that “our semiconductors are sent all over the world. Some may be sent to Thailand, but the actual situation is unclear.” It is still unclear what role Thailand can play in the semiconductor supply chain within Southeast Asia.

(Masuda Atsushi)

Source: ThaiBiz

Disclaimer:

The English version is a translation of the original in Japanese for information purposes only. In case of a discrepancy, the original Japanese edition will prevail.